Key Takeaways

This article explains which dispensary accessories deliver the most reliable margins heading into Q1 2026. It focuses on why multi-store dispensary buyers are prioritizing cleaning products, rolling papers, and cones as stable categories amid evolving regulations. The guide outlines how profitable dispensary accessories support consistent sell-through, reduce operational friction, and help buyers protect margins early in the year.

Q1 is when dispensary buyers feel the impact of decisions made months earlier. After the holiday rush, sales patterns normalize, budgets reset, and every category has to justify its shelf space. For head buyers managing multiple locations, this is the moment where profitability matters more than experimentation.

As regulations continue to evolve and some product categories face increasing complexity, many operators are doubling down on dispensary accessories that deliver reliable margins and consistent sell-through. These categories help stabilize revenue early in the year and reduce operational friction across stores.

For a broader look at how dispensaries are thinking about margin protection heading into 2026, we break that down in more detail in our margin planning guide.

Related reading: How to Protect Dispensary Margins in 2026

Q1 is not the season for guesswork. It is the period when buyers focus on tightening assortments, controlling inventory, and protecting margins across locations. Unlike peak periods, early-year performance exposes which categories truly carry their weight. Accessories often help stabilize revenue early in the year by supporting add-on sales and repeat purchasing behavior, a dynamic that industry analysts have noted when discussing how cannabis accessories can boost retailer margins.

Profitable dispensary accessories tend to share a few traits. They sell steadily regardless of season. They require minimal staff training. They integrate naturally as add-ons rather than competing for attention. Most importantly, they scale cleanly across multiple stores without introducing new operational risk.

These qualities matter more in Q1 than at any other point in the year.

Regulation does not always show up as a direct obstacle, but it often introduces friction. Additional oversight, shifting requirements, and category-specific uncertainty all affect how easily products can be managed across locations.

For buyers, this reality has shifted how accessory strategy is evaluated. Categories that involve fewer regulatory variables are often easier to standardize, easier to replenish, and easier to support operationally. This is especially valuable in Q1, when teams are aligning processes and setting the tone for the year ahead.

Accessories that operate outside the most regulated areas of the business help maintain momentum without adding complexity.

Cleaning products continue to stand out as one of the most profitable and dependable dispensary accessory categories. They address a recurring need, encourage repeat purchases, and do not rely on trend cycles to perform.

High-performance cleaners like Black Label have proven particularly effective because they deliver visible results and build trust quickly. Customers who find a cleaner that works tend to return for it, making cleaning products a reliable reorder category across locations.

From a buyer perspective, cleaning products also function as strong add-ons. They pair naturally with other accessories, support basket growth, and require little explanation at the counter.

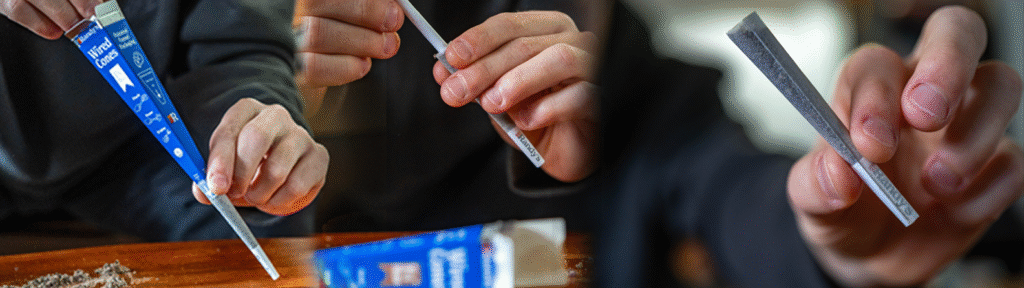

Rolling papers and cones remain some of the most consistent performers in dispensaries, even as other categories fluctuate. These products appeal to a broad customer base and maintain steady velocity regardless of shifts in device trends or regulatory focus.

For multi-store operators, rolling accessories are easy to merchandise and easy to standardize. They help maintain baseline accessory performance and provide stability during slower periods.

In Q1, when buyers are cautious about introducing unnecessary risk, rolling papers and cones continue to justify their place as core inventory categories. Categories like rolling papers and cones remain key drivers of accessory sales because they consistently attract customers, even as other product segments shift. Insights into accessories like rolling papers continuing to drive sales help explain these trends.

Focusing on profitable dispensary accessories does not mean avoiding innovation entirely. It means anchoring assortments with categories that deliver consistent results, then selectively testing new products once stability is established.

Buyers who succeed long term tend to protect their foundation first. Reliable accessories create breathing room, making it easier to adapt to regulatory changes, evolving customer behavior, and category shifts later in the year.

This balance is especially important for multi-store operators, where small inefficiencies multiply quickly.

Strong Q1 performance sets the tone for the year. By prioritizing dispensary accessories that sell consistently, buyers can protect margins early and reduce the need for corrective action later.

For nearly fifty years, Randy’s has worked alongside retailers navigating changing markets and evolving regulations. That long-term perspective continues to guide how we support partners planning for the year ahead.

The best way to understand how profitable dispensary accessories fit into a real assortment is to explore them directly.

Create a wholesale account to review products, pricing, and category depth and see how multi-store buyers are building reliable accessory strategies for Q1 and beyond